American and European Inflation: The Tale of Two Continents

Everyone is aware and most likely has felt the impact of inflation in recent years. In the US and the EU, at the time of writing, the annual inflation rates are respectively 8.26% and 10.1%. To put this into perspective, the long-term average inflation rates are respectively 3.26% and 1.95%. For many people, high inflation is causing significant issues in their day-to-day life. The average American household for example will already spend over $8,600 more this year, assuming no further increase in inflation. Some families across the US and the EU are struggling to make ends meet during these difficult times. In fact, a staggering 78% of registered American voters report inflation has caused financial hardship in their own lives.

In order to curb inflation, leaders are making historic decisions. At the end of July, the European Central Bank (ECB) increased interest rates by 50 basis points (a basis point is 1/100th of 1%) to 0%, which is the first rate hike in 11 years. Meaning that the increase was higher than expected, which ECB president Christine Lagarde justified by saying: “Inflation continues to be undesirably high and is expected to remain above our target for some time. The latest data indicate a slowdown in growth, clouding the outlook for the second half of 2022 and beyond.” This slowdown in growth is a dangerous trend as it will likely lead the ECB to face a severe stagflationary shock, which would be beyond its control. Another recent historic decision was this month's Inflation Reduction Act signed by US President Joe Biden. The recently passed bill was worth $430 billion, which will be used to try and lower the cost of healthcare, prescription drugs and energy.

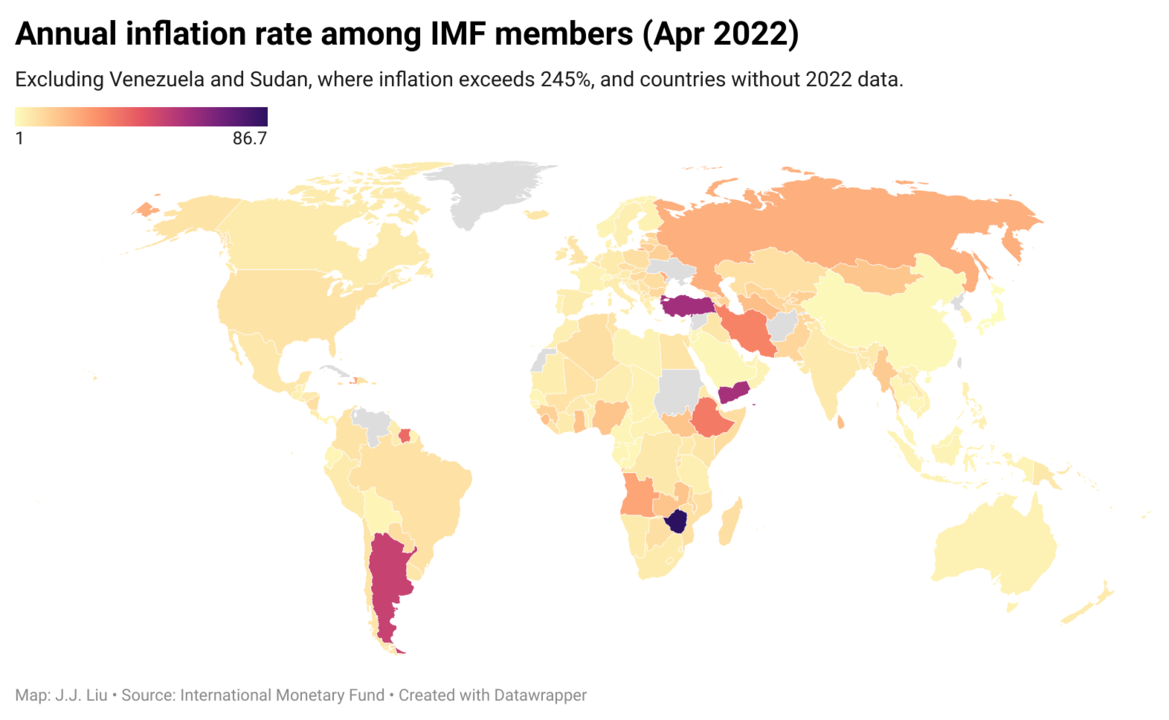

Given the fact that inflation has created major financial anxieties across the population, it may be tempting to offer a quick-fix solution such as price fixing. However, these kinds of solutions may have catastrophic results for the economy. Take for example Venezuela, where price controls completely destroyed the market mechanisms of the economy, leading to massive shortages and a humanitarian crisis. As well as in the US in the 70s, when President Nixon imposed a 90-day freeze on wages and pricing. This was a political success for Nixon but a disaster for the economy (known as the Nixon shock), as it brought on a recession, stagflation and instability in currency markets. So we have to be extremely careful in our response to inflation.

To better grasp the situation, we are going to explore the differences between US and EU inflation, because even though they may be at a similar level, they are not as alike as you may think. First of all, let’s clarify the difference between the Consumer Price Index (CPI) and the core inflation rate. The CPI determines the country’s inflation rate by monitoring the prices of a fixed basket of goods and services purchased by households. This is the inflation rate I have been referring to so far. The core inflation rate is determined by removing short-run volatile components of the CPI and therefore represents the long-run trend in the price level. The effects of events that cause abnormal fluctuations in markets (mainly food and energy) are not well represented in the core inflation rate. For example, the covid crisis, the global shipping crisis and the war in Ukraine.

In the EU, the difference between the CPI and core inflation rate is quite big, they are respectively 10.1% and 4.3%. This indicates that a large part of the current spike in inflation is a result of short-run volatility in key sectors, largely influenced by the sanctions put on Russia. Now, when we look at the US, the difference between CPI and core inflation is rather small. They are respectively 8.26% and 6.32% indicating that short-run volatility is not a big reason for the spike in inflation in the US. So whereas in the EU the inflation is mostly a result of volatility due to short-term events, in the US there are deeper rooted long-term problems causing inflation. We can also see this difference in the financial markets. For example, natural gas prices are about three times as high in Europe as in the US following the war in Ukraine. The data suggest that the magnitude of the fiscal and monetary policy of the US government has been systematically driving up prices. During the previous and current American administrations, there has been a massive stimulus to the US economy. Take a look at Biden’s $2.5 trillion stimulus program and Trump’s $900 billion programs at the end of his tenure. These programs, which together make up 15% of the GDP, have overheated the economy by pushing it beyond productive capacity. These programs may produce concentrated gains, but they also cause long-term consequences, which are now seen in the US economy.

Furthermore, a part of the core inflation in the EU is actually a result of the US stimulus bills. Since 2020, due to these stimulus bills, Americans have spent an additional $600 billion on goods. This combined with the ongoing global supply chain crisis led to an increase in prices worldwide. In the meantime, Europe’s demand fell below its pre-pandemic levels. As a result of the US stimulus bills, Europe is therefore absorbing a part of the inflation produced by the US, while the US takes advantage of the short-term purchasing power benefits. This dynamic is also visible when comparing economic indicators like nominal wages and GDP. Nominal wages in the US have grown by 6% last year, as opposed to 3.8% in the EU. And while Europe’s nominal GDP is 1.4% below pre-pandemic levels, the US is up by 4%.

Looking at the inflation rate from a different angle, therefore, helps us conclude that the sudden increase in inflation in the EU and the US have some similar origins but also some very different ones. The impact of recent events is not the main reason for US inflation, but it is for the EU, which is more dependent on Russian resources. On top of that, the EU’s inflation is being influenced by the US monetary policy, as noted in the last paragraph. Both the US and the EU have introduced extra money into the economy over the last few years, which is a common cause of inflation. However, comparing the CPI and core inflation has shown us that in the US, its own monetary policy is a much bigger factor in inflation than in the EU. This is an important insight when it comes to solving the problem and combating inflation. Especially when less than a year ago, US President Joe Biden, Secretary of the Treasury Janet Yellen, and other notable US government officials disregarded price increases as temporary. But as we have concluded in this article, inflation in the US is everything but transitory. Just this week on September 19th, President Joe Biden downplayed the severity of the inflation by noting it has been relatively constant for a few months. However, this doesn't change the fact that it's the highest rate in 40 years. Biden’s plan to avoid a recession is to “continue to grow the economy”. But whether he realises it’s the fiscal and monetary policy of the US government that has been systematically driving up prices and overheating the economy remains a mystery to me.